![]() Quotidiano Immobiliare dedicates its attention to the survey of Italian hotel real estate, cured by World Capital and its Hotel Investment Index Appeal.

Quotidiano Immobiliare dedicates its attention to the survey of Italian hotel real estate, cured by World Capital and its Hotel Investment Index Appeal.

“In Italy there are more than 33.000 hotel structures, 17% of them are Up-Scale, which means they have 4* and 5*. The 54% are Middle Scale, the classical hotel 3 stars, whereas the other Italian tourist offer is Economy with a 29%. The bedroom offer has over one million divided among 35% Up Scale, 51% Middle Scale and 14% Economy; the most significant data is the average of number of bedrooms for every hotel, which is nearly 32.To these structures we have to add over 125.000 extra hotel ones.

Since some years, the Italian Hotel System started an important transformation trend, which shows a decrease of economy structures. We talk about a decrease of 54% of structures with one or two stars, on the other hand there is an increase of 61% of five stars, 37% for four stars and 6% for three (the increases are determined also by new opening and not only for the replacement effect), trend recorded from the 2006. These are the data, which we have “told” to Chinese investors during our last road show and we have shared them with the Italian operators during the last edition of TTG in the SIA-Guest spaces. We have done it, because the foreign investors have a strong interest for Italian hotel property, also thanks to the growth of tourist market.

In fact, according to UNWTO’s showing, the International tourist arrivals in our Country will reach the 1,4 million in 2020 and over 1,8 million in 2030. At the same time, we expect that the International tourist arrivals from the emergent Countries will overcome those of the other nations into 2020, this dynamic is confirmed by the last data of Eurostat, which highlight how the tourist arrivals in Italy, in first 5 months of 2015, were nearly 35,8 million, with an increase comparing to 4,8% of the same period of the previous year.

Today, the challenge is to success in meeting demand and offer, starting to the awareness that the real estate and hotel worlds talk two different languages, one talks about euros/sqm and the other talks about ADR, REVPAR…

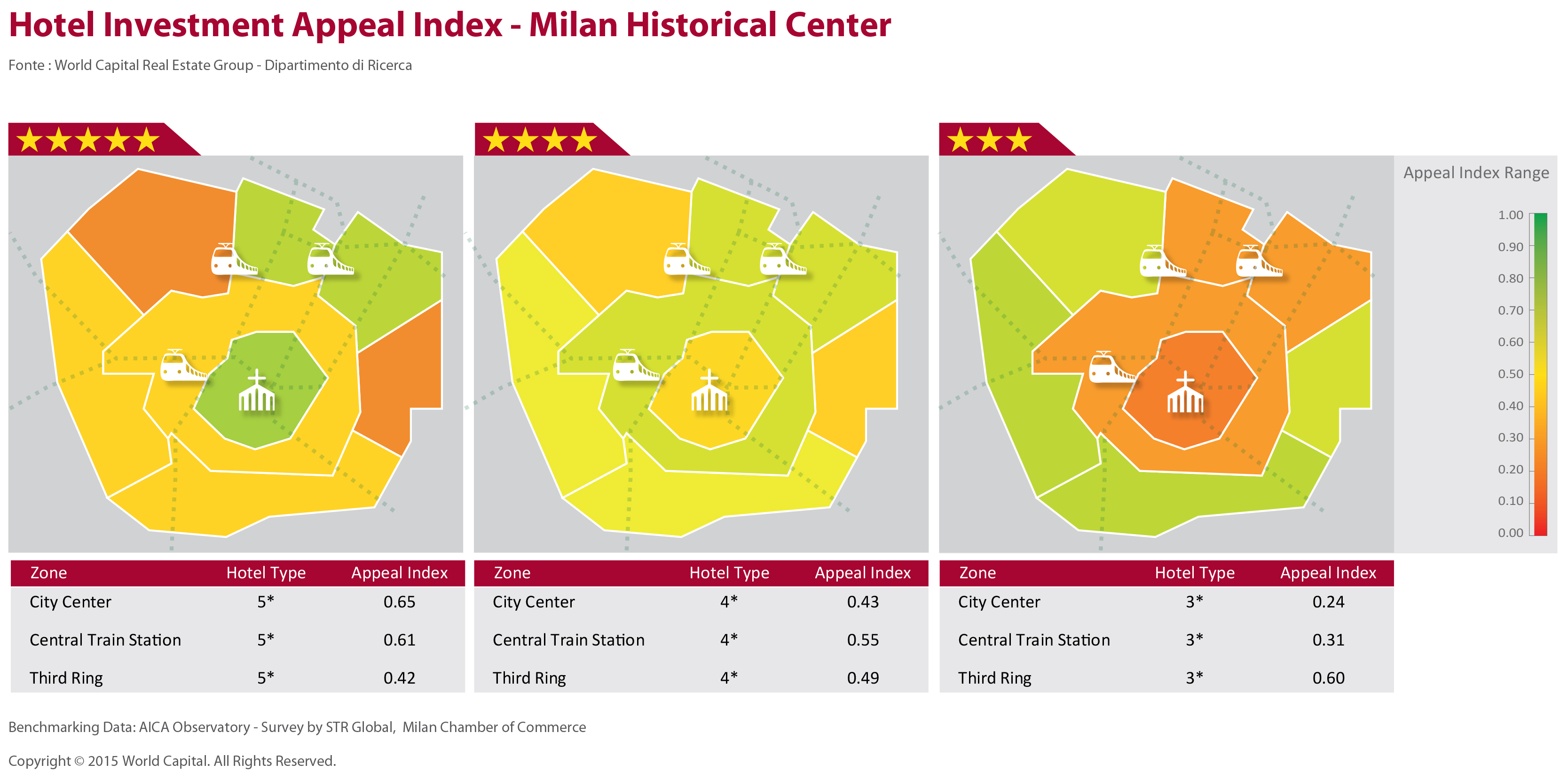

The Hotel Investment Appeal Index is born to replace this challenge. It’s an objective index, built starting from 26 typical real estate indicators and 30 hospitality ones. The result is an index, which defines how, in a particular area, is really possible to realize a hotel structure compare to own category, with earning conditions for both the parts (real estate and tourism). The index is included between zero and one; zero coincides to “it isn’t possible to build a hotel” and one to “ideal location for a hotel”.

Today, we consider just the four principal cities of Italian tourism – Milan, Rome, Florence and Venice -, whereas we are measuring data concerning also other cities/locations, for the next edition, in which we will take part to.

Milan still remains the central area of the city for the best location for Up-Scale hotel with an Appeal Index as 0.65. In the center and in Porta Nuova area, the Middle Scale hotel have a value of 0.55, the Economy structures with 0.60 are in the external areas. The same situation in Florence, where the Cathedral area is the most appealing zone for the hotel 5* with an Appeal Index of 0.69, whereas the best location for 4* is the Bellosguardo quarter in South-West of the city with an index of 0.74. The other central areas result appeling both for the last (0.74), and for 3* which have the major opportunities.

Rome still remains the central area of the city and the best location for Up-Scale hotel with an Appeal Index of 0.79. In the Prati-San Pietro area, on the contrary, both for Middle Scale hotel (0.67) and for Economy (0.64) offer the best opportunities. In Venice, the San Marco/Canal Grande area results the most appealing zone both for hotel 5* (0.78) and for 4* (0.72) and the 3* (0.63); it’s interesting also the Giudecca quarter for all the categories.”